sales pipeline

-

Use Sales Scorecards Because People are Fickle

- April 24, 2024

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

A properly constructed sales scorecard objectively scores an opportunity and accurately predicts whether or not you will win the business. Not to be confused with a marketing scorecard which scores a lead based on how closely it comes to your target customer, a sales scorecard assigns weighted points based on whether the buying conditions are consistent with those that typically result in a win.

-

250 Best Articles on Sales and Sales Leadership by Category

- April 4, 2024

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

These are the top 10 articles in 25 categories on sales, sales leadership, sales assessments, sales performance, sales excellence, sales process and more.

-

Homicide Detective Makes Best Case for Sales Process

- March 21, 2024

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

The author admits that until he conducted his “cold-case investigation” of the New Testament, he was an atheist who always followed the evidence to find the truth. Similarly, a lot of prospects are also non-believers – not necessarily in Jesus – in your product or service. As I read and learned about the author’s methods for uncovering truth, or proof, I felt that salespeople could learn a lot about proof of concept, presenting facts, backing up claims, return on investment, and offering credible testimonials. That’s not nearly the analogy I’m going to make.

Wallace shared a story in the Forward about the time he was shot by a criminal who was on parole, and was not allowed to have a firearm. Up until the moment of the shooting, Wallace believed that a bullet-proof vest would stop a bullet. In the moment of the shooting, he believed in the bullet proof vest. At that moment his belief changed from “belief that” to “belief in.” That was the analogy he wished to apply to the gospels. He wondered if he could find the evidence to replace faith (belief that the miracles occurred) with proof (belief in both Jesus and the miracles).

That also happens to be my analogy from the book. Most salespeople believe that a sales process can help them succeed while the very best salespeople believe in their sales process.

-

Opportunity Blindness – What’s in Your Sales Pipeline?

- February 28, 2024

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

Some observations:

The data represents the forecast and funnel for 7 sales teams.

The gaps (A & G) are backwards and should say 72% (A) and 41% (G).

The quarterly forecast (C) is 58% short of the quarterly target (D).

The current closable opportunities (B) are 77% short of the forecast (C) and 90% short of the quarterly target (D).

Add columns G and H and together, all of those columns represent pathetic, old news.The question that should be asked is, “What can we do about this?”

We should be able to answer that question by looking at column F but that’s not possible. Can you see why?

Outside of telling us that there isn’t enough in the funnel, the data in column F doesn’t answer the question that must always be asked: Is the pipeline viable?

We know the assigned value of the pipeline but we don’t know the answers to these additional ten important factors:

-

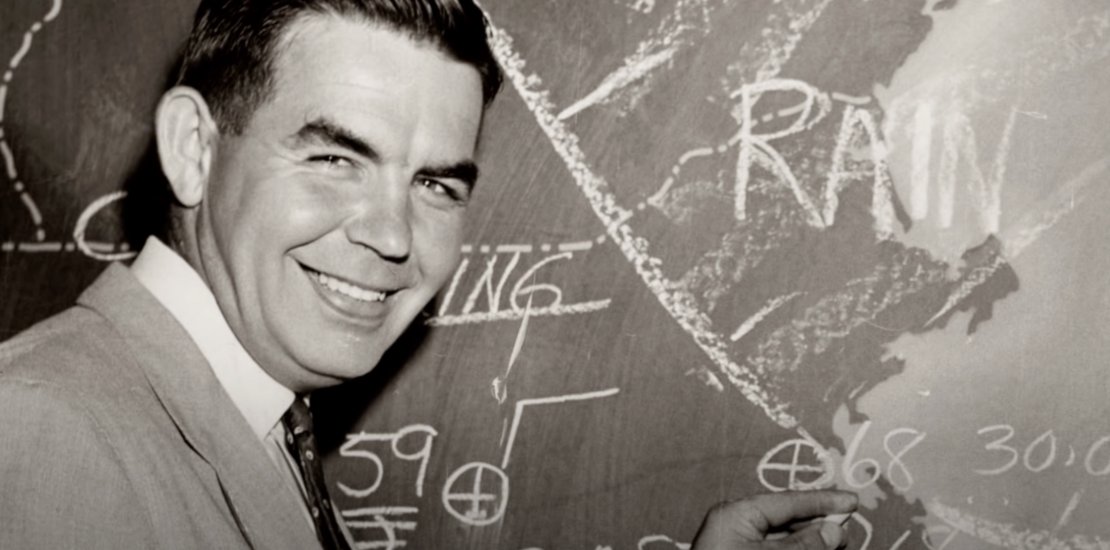

Don Kent and My 8 Reasons For Inaccurate Sales Forecasts

- February 15, 2024

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

1960’s Don Kent is like a 2020’s salesperson. Excited about an opportunity, but wrong. And they don’t have to be wrong, shouldn’t be wrong, and honestly, can’t be wrong. The 2020’s salesperson may not have computer models, but they do have technology and it’s not the technology getting the forecast wrong. It’s the salesperson. There are a number of reasons they get so excited and get it so wrong but here are eight good ones:

-

Sales Process for the Anti-Sales Process Crowd

- January 31, 2024

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

You can look at sales process any way you want but if what you want are more consistent, predictable results, in a framework that supports sales coaching, then you want a customized, formal, milestone-centric, customer-focused sales process and scorecard!

-

Can a New Sales Manager Be a Difference Maker?

- November 9, 2022

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

I speak with so many sales leaders who tell me about the four sales managers they went through in the last two years. I speak with CEOs who tell me about the three sales VPs they went through in the last eighteen months.

There is tremendous pressure to fill these roles because your team’s performance will suffer without someone at the helm. Or is that misinformation? How much worse could a team perform than how they perform under a sucky sales manager?

-

Bob Chronicles Part 6 – When Salespeople Suddenly Make Things Your Problem

- January 20, 2022

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

Bob was informed 2 weeks ago that an important customer proposal would be due by the end of business today. At 4pm, Bob was in a panic, screaming that he needed pricing in the next 10 minutes or you’ll lose the business. Suddenly it has become your problem.

-

Top 10 Sales and Sales Leadership Articles of 2021

- December 7, 2021

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

There are several criteria for choosing the top articles of the year, including, but not limited to:

Views (Article)

Popularity (likes on LinkedIn and Twitter)

Engagement (comments to the article, via email, and on LinkedIn)

Personal (my favorites)

Value (insights for the community) -

Salesenomics – Many Sales Organizations Are Stuck in the 1980’s

- November 22, 2021

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

When was the last time you saw a black and white television or even a console color TV?

How about an electric typewriter?

Or a car that didn’t have anti-lock brakes?

You would have to return to the 1980’s to see those things and when it comes to their operations, some sales organizations are still in the 1980’s.

For example, check out these statistics from OMG’s evaluations of 30,000 sales teams and more than two million salespeople.