sales statistics

-

Most Companies Can Boost Sales From 30-100% in Just One to Two Years

- September 10, 2020

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

Many companies already experienced at least 3 to 6 months of uncertainty and they can not withstand even 2 more months of that. As a result, companies are investing, streamlining, expanding, hiring and going all in to save their 2020s, and position their companies for historical growth in 2021.

-

Salespeople in Small Companies are 43% Better at This and Other Salesenomics Insights

- January 7, 2020

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

You seek out the best products, best stores, best websites and best experiences. Doesn’t it make sense to wonder about where you can find the best salespeople?

I asked Objective Management Group’s (OMG) COO, John Pattison, to dig into some of our data from the evaluations of 1,932,059 salespeople from companies and provide me with some scores.

I reviewed the data and have a number of very interesting and surprising Salesenomics conclusions to share.

-

New Data Shows Sales Weaknesses Cause Powerful Chain Reactions in Salespeople

- May 30, 2018

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

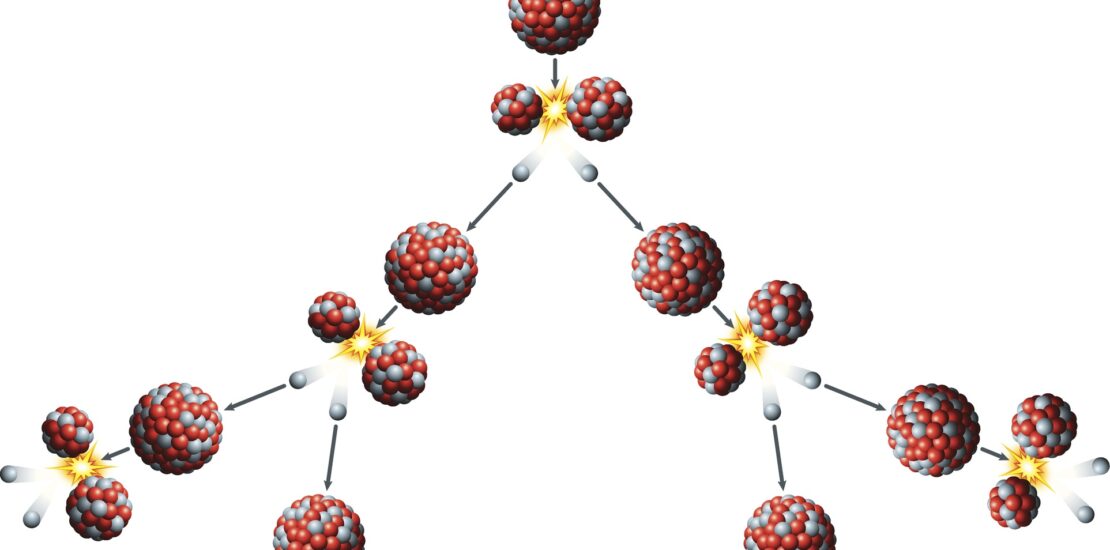

I have written extensively about Sales DNA over the years and today we will view Sales DNA from the perspective of sitting inside of a chemistry lab.

Sales DNA is the combination of strengths (or weaknesses) that support (or sabotage) the execution of sales process, sales strategy and sales tactics. Objective Management Group (OMG) measures and includes the 6 most powerful of those strands of Sales DNA in its 21 Sales Core Competencies. While I usually discuss the impact of these weaknesses, we have never conducted a lab experiment like this before!

-

The Official 2017 List of 21 Sales Core Competencies

- March 15, 2017

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

These days, changes happen faster than ever and the same can be said about professional selling. Selling is evolving, the rules of business are changing, there is more information available on line than there was last week and sales organizations must evolve accordingly.

-

Misleading Statistics and Hiring the Wrong Sales Candidates

- November 3, 2008

- Posted by: Dave Kurlan

- Category: Understanding the Sales Force

The November issue of Fortune Small Business has an article called Entrepreneurial Myth Busters. FSB has Ken Blanchard (consultant )and Scott Shane (academic) go head to head answering questions about small businesses and entrepreneurship. While Blanchard provides insightful answers based on his years of experience working in, consulting to and writing about business, Shane provides surprising answers based on data. I’m sure that if you read the article you’ll agree that Shane’s data lead to some very misleading conclusions. Academics who haven’t been “out there” can fall in love with their data!